contract negotiations

SIP Simplified. How many SIP trunks does your company need?

WHAT IS SIP AND WHY DOES IT MATTER?

SIP (Session Initiation Protocol) is an internet protocol like HTTP. SIP makes it possible to securely connect voice, video and data calls through the internet or private cloud based network.

THE BASICS

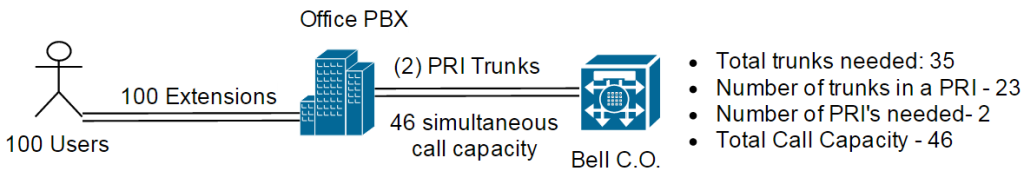

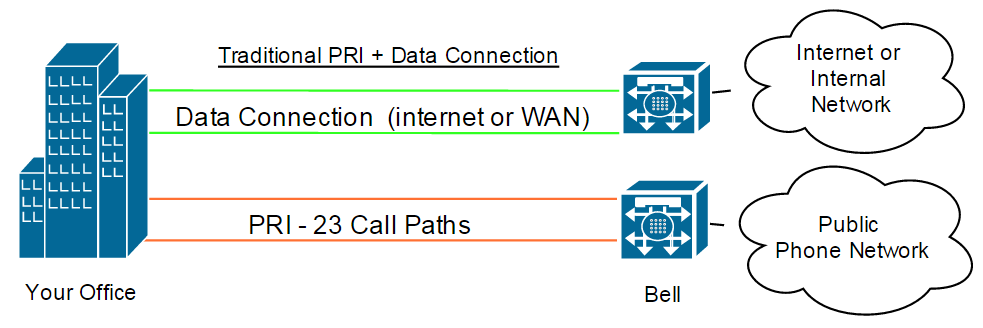

The number of PRI/T-1’s or POTS lines decide how many concurrent calls or (call paths) you can make between your company’s PBX and the PSTN (Public Switched Telephone Network); through the Bell Central Office. In the example below 2 PRI (23 call paths each), would need to be purchased. (See below).

THE NUMBERS

The following table provides the average ratio of SIP trunks per user across multiple business types. Each company is different however. A manufacturing company may only need a 10% ratio where a call center or brokerage firm may need a 90% ratio.

| Users | Avg. SIP Trunks Needed | Ratio |

|---|---|---|

| 5 | 3 | 60% |

| 10 | 5 | 50% |

| 50 | 20 | 40% |

| 100 | 35 | 35% |

| 250 | 80 | 32% |

| 500 | 150 | 30% |

| 1,000 | 280 | 28% |

| 5,000 | 1,000 | 20% |

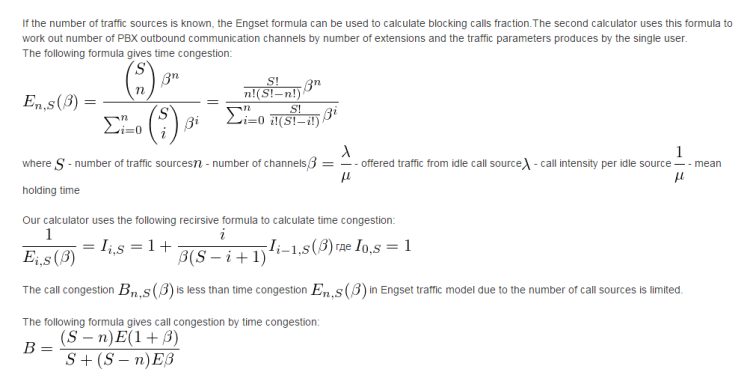

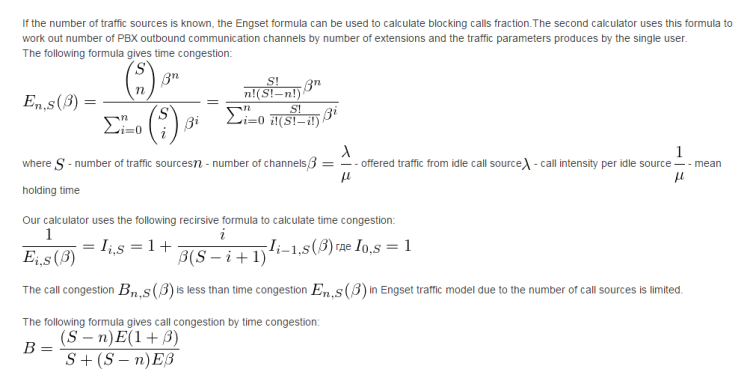

In the old days, people used Erlang formulas to calculate trunk requirements.

Thankfully these calculators can be found on a number of websites. Here is a link to one of them. PBX Channel Calculator.

WHY DOES THE RATIO OF TRUNKS GET SMALLER WITH MORE USERS?

If you have a 2 person office, it is likely that both users could be on calls at the same time. You would need a 1:1 ratio or 2 trunks. If you have an office of 10 people, typically only 60% of the people may need to be on concurrent calls. And so on… As your population gets larger, statistically the % of people on the phone declines.

HOW DOES SIP WORK IN A MULTI-LOCATION ENVIRONMENT?

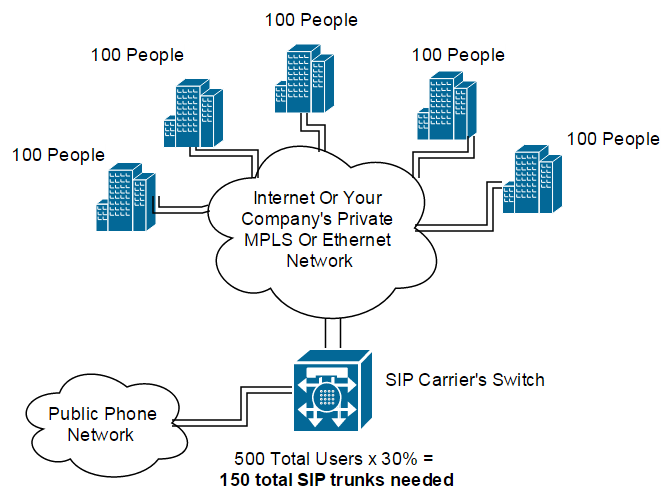

I will use the following example of a company with 5 offices, each with 100 people.

Using traditional methods, your company would have to install, and pay for, 2 PRI (46 call capacity each) for a total of 10 PRI and a call capacity of 460 concurrent calls. This is wasted spend. SIP providers aggregate all of your calls to the PSTN using their own switch. By aggregating these calls, your company can apply the trunk ratios based on the total of all users, from all locations. In the case above, instead of paying for 460 trunks using PRI, your company may only need 150-200 SIP trunks. This represents a significant savings.

HOW DOES MY COMPANY CONNECT TO A SIP NETWORK?

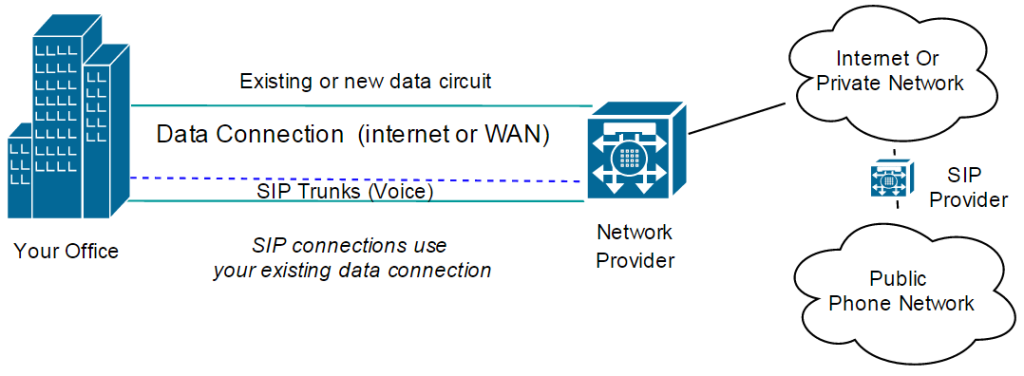

Companies that use PRI’s typically need two different connections. The PRI for voice and a separate data connection for the internet or private network. SIP can either be provided as a separate data connection from the SIP provider or can be delivered using your existing internet/private network connection. This eliminates the need for two separate circuits. To ensure voice quality, a (fast lane) is established inside your data connection. This means that spikes in data will not take away bandwidth from the SIP lane. This prevents the garbled or digitized sound that was prevalent when Voice over IP first came out. You may however, need to increase bandwidth to accommodate the additional voice calls. Given the low-cost of bandwidth today, it is typically still more cost-effective than a PRI + Data connection.

Buying SIP services does not come without risks. At 10,000 feet, things seem pretty simple. At 1 inch, things can get complex. When it comes to selecting a SIP vendor, it is important to choose the right features, technical specifications and to negotiate the right terms and pricing. Since no company is going to highlight their weaknesses, it is best to work with a company that has had real world experience with these services and companies.

For further information and/or a complementary evaluation please contact us.

Contact UsHow to avoid revenue commitment traps and gain complete control at the negotiating table

A detailed Review of Interval, Attainment and Term Revenue Commitments

After negotiating hundreds of contracts, from dozens of carriers, for clients ranging from global 50 to $50M/year in revenue, I feel I have a unique perspective on this topic. In my experience, I have found that revenue commitments, are to a large extent, arbitrary. Although contrary to popular belief, I regularly find that companies who spend $1M/year will get better rates than companies who spends $10M/year with that same vendor. (I will explain why and how to avoid this phenomenon in another post).

Revenue Commitments Are Designed To:

- Generate predictable revenue streams for carriers

- Insure that the clients are captive customers

- Defend current revenues from would be competitors

- Create significant negotiating advantages at contract renewals

- Increase margins over time

What % Of Your Total Spend Should You Be Willing To Commit?

Vendors would prefer that you commit 100% of your spend… forever. Typically, vendors will come up with a commitment figure that is 80% of your annual spend. We usually recommend that clients commit no more than 60% of their projected spend over the term, not per year. I will demonstrate below why term based commitments are superior and why you would want to stay away from monthly and annual commitments. For an example, I will use a customer that spends $100k/month or $1.2M/year on a 20 site voice and data network.

Interval Based Commitments

These are the most commonly offered terms. Even if a customer spends 10x the sum of all three years commitment, in the first year, the customer will still be liable for the annual commitment in years two and three. These types of commitments are the most restrictive and, if possible, should be enthusiastically avoided. Some of the terms associated with these types of commitments includes:

- MARC – Minimum Annual Revenue Commitment

- Take Or Pay – Either Use A Minimum Amount Or Pay For It Anyway.

- MMRC – Minimum Monthly Revenue Commitment

- MAC – Minimum Annual Commitment

- ARC – Annual Revenue Commitment

The table below demonstrates the one of the most negative aspects of an annual commitment.

| Year 1 | Year 2 | Year 3 | Totals | |

| Monthly Spend | $100,000 | $100,000 | $100,000 | $300,000 |

| Annual Spend | $1,200,000 | $1,200,000 | $1,200,000 | $3,600,000 |

| % Of Annual Commitment | 60% | 60% | 60% | |

| Annual Committed Spend | $720,000 | $720,000 | $720,000 | $2,160,000 |

| Number Of Spend Months Required Each Year To Satisfy Commitment | 8 | 8 | 8 | |

| Number Of Months Remaining Before Auto-Renewal At The End Of The Term | 2-3 |

In this case, the customer has already spent more than the aggregate committed dollar amount by month 21. Since the customer still has the 3rd year commit to satisfy, the customer is stuck for the duration. During year 3, the customer will still have to give the carrier an additional $720K to satisfy the 3rd year annual commitment. In effect, the real commitment ends up being $3.12M. ($2.4M for years 1 and 2 + $720k for year 3) Unfortunately, most of the agreements we see before renegotiating have a 30-60 day auto-renewal clause. By the time your company has satisfied the commitment, there is only 2-3 months left to do anything about it. Since the incumbent knows it can take 4-6 months to move a large data network to another carrier, the customer no longer has any leverage in the form of a credible alternative. Advantage: (Vendor)

Attainment Based Commitments

If interval agreements represent (the stick), attainment agreements represent (the carrot). Attainment agreements create the feeling that you’re not being forced to spend money with the vendor. This is true. However, if not structured correctly, they can be equally restrictive when it comes time to renew an agreement. If the discount tiers and the requirements to reach them are not carefully negotiated, drops in spend or movement of business elsewhere can reduce the discounts enough, on the remaining spend, to be cost prohibitive. ATT and Verizon use both the carrot and the stick. If you sign a revenue commitment with carriers like this, they will be happy to give you huge (60-90%) discounts off their standard tariff prices. Only when the carrier has delayed the renewal proposal long enough to leave you with no other options, you realize that if you do not renew the agreement, your costs will go back up by that same 60-90%. Advantage: (Vendor)

Total Spend Based Commitments

This category of revenue commitment takes into account your total projected spend during the entire contract period. Some of the terms associated with these includes:

- MTRC – Minimum Term Revenue Commitment

- MTM – Minimum Term Commitment

- Burnout – Once total spend is achieved, the commitment is burnt out and gone.

Note: Vendors do NOT like to agree to these. In most cases, the carrier will deny that they have ever offered them. Having the right negotiating strategy is critical. As long as you have someone on your team that has either negotiated these types of commitments before and/or has evidence that the carrier has offered these terms to other companies, you will have a better chance of success.

In this example, the 60% revenue commitments remains the same however, we have removed the annual minimum requirement.

| Year 1 | Year 2 | Year 3 | Totals | |

| Monthly Spend | $100,000 | $100,000 | $100,000 | $300,000 |

| Annual Spend | $1,200,000 | $1,200,000 | $1,200,000 | $3,600,000 |

| Total Committed Spend Over 3 years (60%) | $2,160,000 | |||

| Cumulative Spend | $1,200,000 | $1,200,000 | $1,200,000 | $3,600,000 |

| Number Of Spend Months Required To Satisfy Entire Commitment | 22 | |||

| Number of Months Before Renewal With No Revenue Commitment | 14 |

By taking this approach, the customer satisfies the total $2.1M commitment in month 22 of 36. This means that the customer no longer has any obligation to the carrier, but the carrier is obligated to keep the current rates and terms in place for the next 14 months. The customer is in complete control at this point. Figuratively speaking, the Sword of Damocles is transferred from over the head of the customer to that of the carrier. Negotiating from a position of complete control enables our clients to get better SLAs, terms and pricing than companies with a less favorable negotiating position. Advantage: (Customer)