IT Insights

SIP Simplified. How many SIP trunks does your company need?

WHAT IS SIP AND WHY DOES IT MATTER?

SIP (Session Initiation Protocol) is an internet protocol like HTTP. SIP makes it possible to securely connect voice, video and data calls through the internet or private cloud based network.

THE BASICS

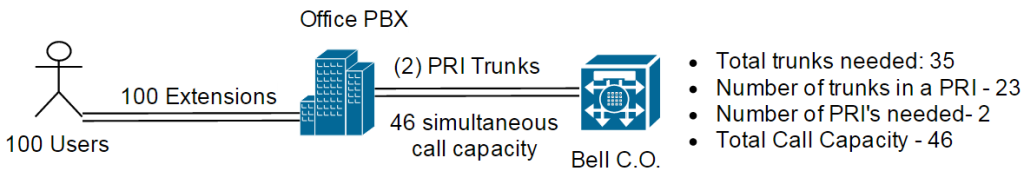

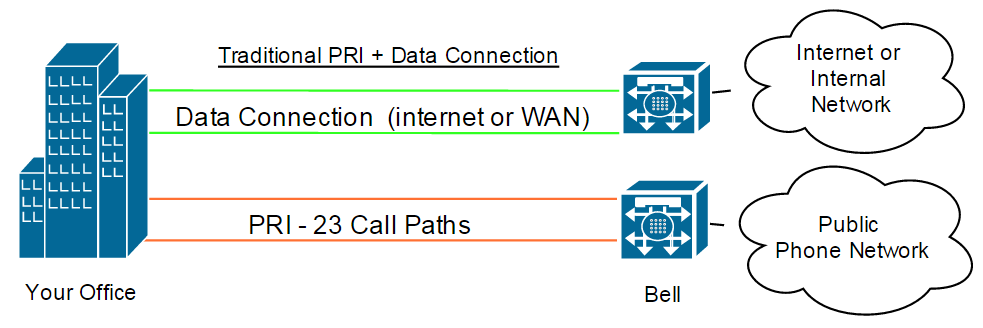

The number of PRI/T-1’s or POTS lines decide how many concurrent calls or (call paths) you can make between your company’s PBX and the PSTN (Public Switched Telephone Network); through the Bell Central Office. In the example below 2 PRI (23 call paths each), would need to be purchased. (See below).

THE NUMBERS

The following table provides the average ratio of SIP trunks per user across multiple business types. Each company is different however. A manufacturing company may only need a 10% ratio where a call center or brokerage firm may need a 90% ratio.

| Users | Avg. SIP Trunks Needed | Ratio |

|---|---|---|

| 5 | 3 | 60% |

| 10 | 5 | 50% |

| 50 | 20 | 40% |

| 100 | 35 | 35% |

| 250 | 80 | 32% |

| 500 | 150 | 30% |

| 1,000 | 280 | 28% |

| 5,000 | 1,000 | 20% |

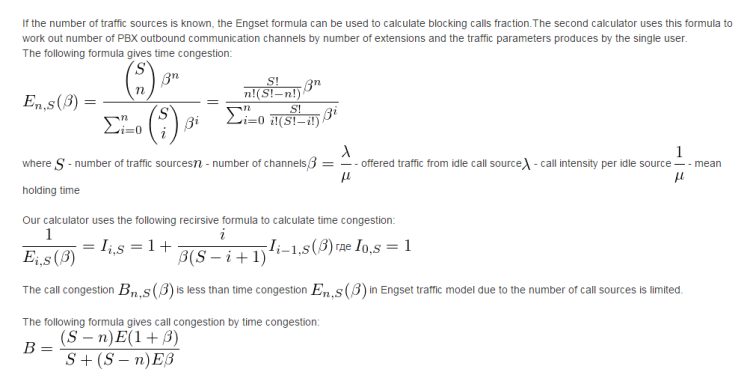

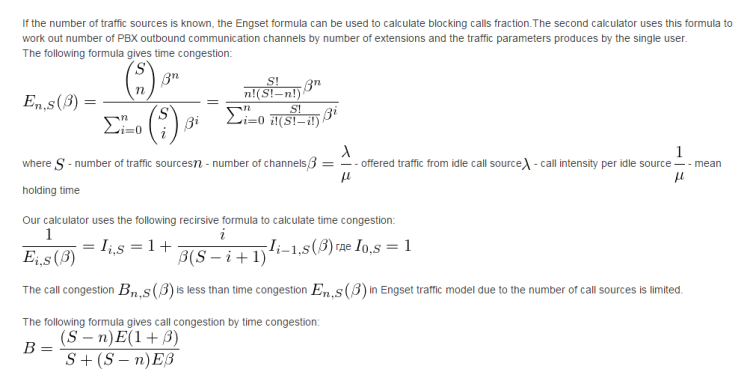

In the old days, people used Erlang formulas to calculate trunk requirements.

Thankfully these calculators can be found on a number of websites. Here is a link to one of them. PBX Channel Calculator.

WHY DOES THE RATIO OF TRUNKS GET SMALLER WITH MORE USERS?

If you have a 2 person office, it is likely that both users could be on calls at the same time. You would need a 1:1 ratio or 2 trunks. If you have an office of 10 people, typically only 60% of the people may need to be on concurrent calls. And so on… As your population gets larger, statistically the % of people on the phone declines.

HOW DOES SIP WORK IN A MULTI-LOCATION ENVIRONMENT?

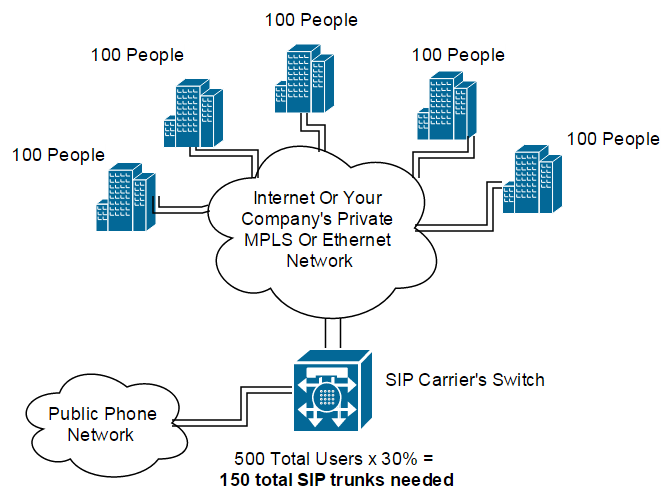

I will use the following example of a company with 5 offices, each with 100 people.

Using traditional methods, your company would have to install, and pay for, 2 PRI (46 call capacity each) for a total of 10 PRI and a call capacity of 460 concurrent calls. This is wasted spend. SIP providers aggregate all of your calls to the PSTN using their own switch. By aggregating these calls, your company can apply the trunk ratios based on the total of all users, from all locations. In the case above, instead of paying for 460 trunks using PRI, your company may only need 150-200 SIP trunks. This represents a significant savings.

HOW DOES MY COMPANY CONNECT TO A SIP NETWORK?

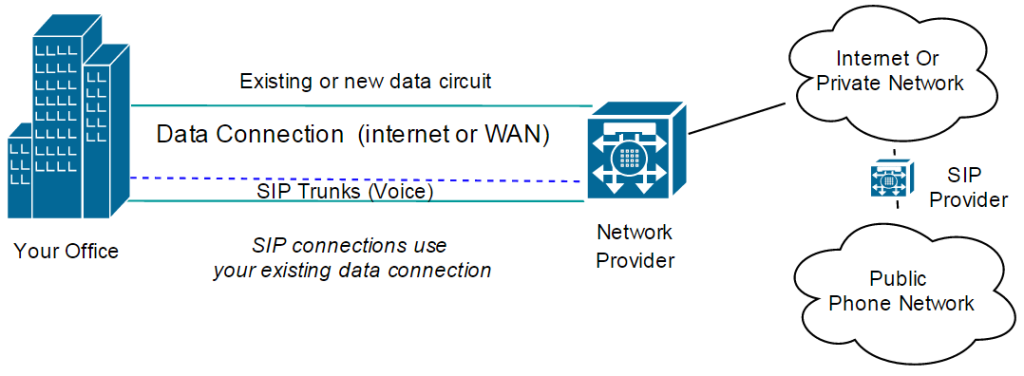

Companies that use PRI’s typically need two different connections. The PRI for voice and a separate data connection for the internet or private network. SIP can either be provided as a separate data connection from the SIP provider or can be delivered using your existing internet/private network connection. This eliminates the need for two separate circuits. To ensure voice quality, a (fast lane) is established inside your data connection. This means that spikes in data will not take away bandwidth from the SIP lane. This prevents the garbled or digitized sound that was prevalent when Voice over IP first came out. You may however, need to increase bandwidth to accommodate the additional voice calls. Given the low-cost of bandwidth today, it is typically still more cost-effective than a PRI + Data connection.

Buying SIP services does not come without risks. At 10,000 feet, things seem pretty simple. At 1 inch, things can get complex. When it comes to selecting a SIP vendor, it is important to choose the right features, technical specifications and to negotiate the right terms and pricing. Since no company is going to highlight their weaknesses, it is best to work with a company that has had real world experience with these services and companies.

For further information and/or a complementary evaluation please contact us.

Contact UsIs Your Company Paying Microsoft Too Much?

IS YOUR ENTERPRISE PAYING MICROSOFT MORE THAN NECESSARY?

In any dynamic organization, license consumption, new products, new releases, cloud solutions and IT infrastructure rapidly changes. In the “old days” (more than 5 years ago), Microsoft did not have many true (Credible Threats) to applications like Windows, Outlook and Office; to name a few. Without any real competition, Microsoft considered their customers, “Captive” and thus had little incentive to negotiate.

Fast Forward. In the last 5 years there has been an explosion of cloud based platforms from big and small software providers. Never before has the number of licensing and vendor options changed so dramatically. For the first time, there are now real credible options (Threats) to almost Microsoft’s entire product line for almost every size company.

CONTROL

In order make sure their customer’s stay captive in the face of such threats, Microsoft wants to make themselves irreplaceable. The more interwoven they are into the very fabric of a company’s DNA, the more disruptive a vendor or technology change would be. This creates control. Example: Say you’re a CIO of global enterprise with 20,000 employees all running Outlook, Office and Windows, CRM, Server, MySQL, Azure and other key business apps. 6 months before your renewal, Microsoft raises their pricing by 40%. What do you do? You pay it. At this point, you have no other choice. You don’t have to be a mega company either. Smaller companies find themselves in the same conundrum; albeit on a different scale. In short, the more Microsoft products you embed into your business, the less likely they are to negotiate the best prices and terms.

RELEASE CYCLES

To add to the challenges of negotiating the best pricing with Microsoft is their constantly changing products from their licensing bundles and revising usage terms. The fact is, few companies are perfectly aligned with Microsoft’s release cycles; it’s well-known that most tend to lag a cycle or two behind. Microsoft’s pricing structures can be complex and opaque. Some list prices (Microsoft calls them “ERP” – Estimated Retail Price) are published. It’s possible to get competitive reseller quotes for volume licensing programs such as Open and Select Plus, but Microsoft does not publish pricing for the direct-with-Microsoft agreements such as Enterprise License Agreements (ELA). Unless you work with a company that regularly evaluates Enterprise agreements and custom pricing, it is unlikely you would know whether you’re getting the best terms.

MORE IS NOT ALWAYS LESS

It seems perfectly logical to think that if you put all your eggs with Microsoft that you will get a bigger discount and a better per unit price. In negotiating with Microsoft total spend is important, but control can be as important. We have negotiated Microsoft license agreements with a large number of companies ranging from Global Fortune 500 companies to companies with only $50-$100M in revenues. Because we see it all, we have a unique perspective on real market pricing and how things really work. Although contrary to popular belief, companies who are less reliant on Microsoft products tend to pay less per unit than those who are most heavily invested in the Microsoft technology stack. One way to improve your negotiating position is to diversify some of your software platforms. Having all your eggs in the Microsoft technology stack, means you’re likely to pay more per unit in the long run. Provided the solutions fit your needs, it is generally better to have 3-4 more easily replaceable vendors than 1 vendor who already has all your business and knows you’re not going anywhere. In this scenario, the negotiating advantage moves from Vendor to Customer.

BUY ONLY WHAT YOU NEED

Microsoft is notorious for including everything AND the kitchen sink into their deals. The number of SKUs found in an agreement can be overwhelming. Does everyone really need every application? Why pay for every application for every employee if they only use Outlook, Excel and Word. Understanding the needs of the business is important in negotiating deal. We recommend negotiating the best price for all the services and bundles and get detailed cost per SKU figures. Having a good software asset management system prior to negotiations can offer you the detail you need to right size your next ELA. Once established, remove the SKUs you do not need and create additional savings. These license agreement are complex. If you don’t know how all this works, get outside help from a company that does.

ESTABLISH CONTROL

If you are going to start negotiations with Microsoft or a VAR, you need be prepared. To start off, Microsoft has a huge chip on their shoulder. They still have the mentality that all of their customers are captive and thus are not inclined to do anything off book. The most important fundamental strategy in negotiating with Microsoft is to change their perception that you are captive. You need to do your homework first. You should know and be ready to discuss who their key competitors are, pricing models, how the competition is better, faster, cheaper. You should know, how long it would take to transition to a competitor and a high level transition plan. Without violating any Non-Disclosure Agreements, you should have detailed comparative cost models, showing how much vendor A, B & C will save your company and offer a better solution. The more detailed the better. These data points and models are invaluable in negotiations. The fear of lost business is the most powerful way to negotiate special discounts not offered to other companies. More so than with most companies, Microsoft needs to be convinced that they are replaceable. Once established, you will find that Microsoft will be more accommodating in providing special custom pricing.

NEGOTIATIONS

After negotiating over $116M in Microsoft ELAs, and saving clients over $54M, we feel comfortable saying that we are experts on this topic. There is no simple formula to negotiating the best price and the best agreements. Each company has different needs, levels of Microsoft integration and other variables that all need to be analyzed to create a winning strategy. Although I will not go into the more technical aspects of all the different Microsoft licensing options in this blog post, I hope you gained some insight.

We highly recommend getting outside expertise from a company that has done this repeatedly and can help your company avoid the landmines and structure the most advantageous and cost-effective agreements.

If you would like to discuss renewal strategies, or find out if you’re paying too much to Microsoft or any other software, hardware, telecom or mobile services vendors,