Complete Healthcare Cost Reduction And Containment Services

Optelcon’s Healthcare Cost Containment Network will reduce your company’s past, present & future healthcare costs?

The cost of health care benefits is among the largest expense items for most employers. Along with comprehensive healthcare reform, self-insured employers are facing additional pressures to ease the financial strain through conducting audits of their benefits plans. Industry experts in Human Resources along with Internal Audit executives commonly recommend that all sponsors of health care benefit plans periodically conduct an independent audit of their third-party claims administrators. Many employers have never conducted an audit, yet they provide draft authority on their bank account for the third-party administrator to issue funds to pay the organization’s health care claims. Increased scrutiny by the Department of Labor relative to proper discharge and monitoring of fiduciary duties by employers and/or sponsors of group health plans may be reason enough to conduct an audit. Plan sponsors put a lot of effort into designing health care benefits for their employees and want to be assured that these benefits are being provided at the right cost.

The cost of health care benefits is among the largest expense items for most employers. Along with comprehensive healthcare reform, self-insured employers are facing additional pressures to ease the financial strain through conducting audits of their benefits plans. Industry experts in Human Resources along with Internal Audit executives commonly recommend that all sponsors of health care benefit plans periodically conduct an independent audit of their third-party claims administrators. Many employers have never conducted an audit, yet they provide draft authority on their bank account for the third-party administrator to issue funds to pay the organization’s health care claims. Increased scrutiny by the Department of Labor relative to proper discharge and monitoring of fiduciary duties by employers and/or sponsors of group health plans may be reason enough to conduct an audit. Plan sponsors put a lot of effort into designing health care benefits for their employees and want to be assured that these benefits are being provided at the right cost.

No one company handles every aspect of healthcare cost containment. As our client’s “savings integrator”, Optelcon has developed the “Optelcon Healthcare Cost Containment Network”. This is a network of pre-screened healthcare, cost containment, and specialty companies. The network is made up of innovators and leading specialty cost reduction and containment firms that deliver results. Under one umbrella, Optelcon provides our clients with a mix of capabilities and expertise that you will not find with any single healthcare cost reduction company. Only companies that exhibit the highest skill, and integrity and are clearly passionate about saving clients’ money get the opportunity to work with Optelcon’s clients.

Below is a listing of popular comprehensive benefits auditing solutions for both self-insured and fully-insured organizations.

Optelcon’s MBR audits focus on accurate billing and coding of Inpatient claims using the billing/coding rules and guidelines established by the Centers for Medicare and Medicaid Services (“CMS”), which create the standard billing/coding practices for facilities in this country. Our MBR audit services also take into consideration coding norms from other well-respected authoritative sources and industry publications (e.g., the American Medical Association, also known as the “AMA”). In short, the results and recommendations presented in our MBR audit reports are sound and extremely defensible. Such areas of focus include:

- Unbundled charges or inclusive services

- Up-coded services

- Duplicate charges

- Excess utilization of services

- Potential incompatibility with gender and/or diagnosis(es)

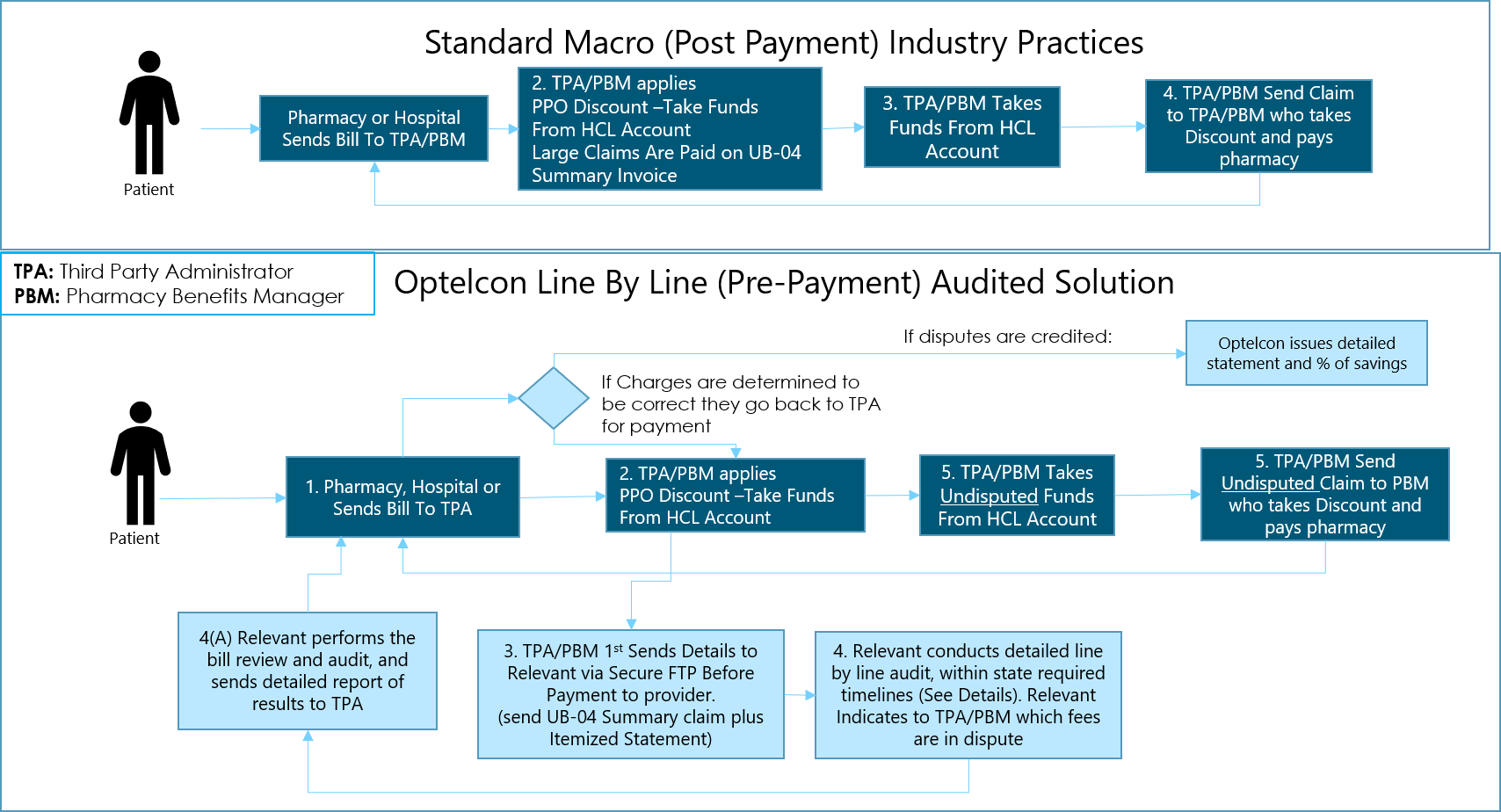

Optelcon MBR Audits focus on line item costs. The TPA may have paid a claim correctly, but the line item cost may be in error or egregious. i.e. $250 for an aspirin, 2 beds for one person, a shoulder MRI for someone diagnosed with the flu, tests or procedures that do not correlate with diagnosis, etc. We audit each line item BEFORE the TPA or PBM adjudicates the claim. The funds from disputed charges are not paid until confirmation of the accuracy is completed by our team. This prevents the TPA or PBM from taking errant claim amounts from your account in the first place. Like the IRS, it’s a lot harder to get your money back once it has already been paid.

Claim Audit Types

Below is a listing of popular comprehensive benefits auditing solutions for both self-insured and fully-insured organizations.

- Line Item (pre-payment) Medical Bill Review and Audit

- Historical Medical Claims Audit

- Prescription Drug Claims Audit

- Dental Claims Audit

- Vision Claims Audit

- Pre-Implementation Claims Audit

- Line by line, pre-adjudication audit

- Other Benefit-Related Audit Solutions

Why Do Errors Happen?

Electronic claims payment systems minimize errors, but the complete claims payment process relies on human judgment. Multiple combinations of factors exist that attribute to claims payment issues such as:

- Weak investigative efforts

- Volume pressures

- Poor claims payment systems or outdated software

- Internal policies prevail over plain language

- Human misinterpretation during plan setup

Audit IQ

Audit IQ is a Health care claims auditing software designed to efficiently and effectively identify errant payments. Users include Insurance Carriers, Third Party Administrators, Self-paying Employers, Employers, and Employee Benefits Consultants/Brokers.

Engine

FiLTER iQ is an intelligent and highly selective software analytical engine that can interpret and process benefit design logic. FiLTER iQ is the foundation for AUDiT iQ™’s modules: Medical, Dependent Eligibility, Rx, and Dental.

Medical Module

The Medical module comes complete for auditing all aspects of a medical health plan and its associated claims data. A comprehensive set of medical codes are included with the software and are fully integrated into the auditing process. These code sets include AMA CPT®, AMA HCPCS, AMA ICD-9, and CMS Revenue codes. The Medical module is based on over 80 categories that have been pre-tuned and configured out of the box to use the most appropriate medical codes available. In addition, each category can be configured to capture benefit design metrics related to deductibles, co-insurance, in-network / out-of-network payment levels, dependents, maximums based on occurrences or incidents, and others. Some examples of audit categories include:

- Duplicates

- Medical Necessity

- Potential Other Party Liability

- Excluded Services (acupuncture, cosmetic procedures, . . .)

- Limited Services (chiropractic, physical therapy, . . .)

RX Module

The Rx module is tailored for pharmaceutical claims. Categories have been created to effectively audit many aspects of any pharmaceutical benefits plan including co-pays, exclusions, limitations, AWP and MAC pricing discounts, as well as other criteria. It utilizes both historical and current databases published by First Data Bank to define the Rx categories and assist with the analysis of the claims data.

Dental Module

The Dental module comes pre-configured with categories that effectively audit dental claims. Using the American Dental Association’s Current Dental Terminology (CDT) code set, AUDiT iQ™ can intelligently assess benefit design metrics related to co-insurance, exclusions, deductibles, maximum benefits, and others.[/accordion]

Dependent Eligibility Module

The Dependent Eligibility module is designed to accept various plan eligibility criteria and use those factors, along with the eligibility data, to build the communications/mailings, track each employee response, and report those responses in a real-time tabular or graphical manner.

Do you know how much your company is paying for ineligible employees and their family members? Dependent validation and eligibility audits are one of the fastest and easiest ways to cut health care costs

Why should my company perform a Dependent Eligibility Audit?

On average, our clients achieve a 96% participation rate or higher with 2-10% of dependents found to be ineligible. By finding and removing these ineligible members from your plan, companies save an average of $3,000/year per member. This often means savings far exceeding the actual audit costs with returns on investment ranging from 100% to over 5,000% just for the first year alone.

How do we validate whether or not a member is eligible?

How do we validate whether or not a member is eligible?

- We send each member a pre-paid envelope, fax number, and weblink with instructions and a list of the documents required to validate their eligibility

- Our multi-lingual call and service center receives the information via phone, email, and postal mail.

- Our systems logs and track all of the information sent by members

- Our team sends out reminder texts, emails, and calls

- Members are given a time specified by our clients, to return their validation documentation

- Members who do not meet the requirements or do not return the required documents are flagged and removed from the coverage.

What’s included in our service?

- We first determine your specific plans eligibility requirements

- Mailing fulfillment, postage, and audit setup

- Prepaid business reply envelopes

- Inclusion of multiple eligibility definitions and carriers

- Verification of spousal surcharge/carve-out

- Appeals handling and processing

- Reminder outbound calls or text messaging

- Status complete and incomplete notification

- Timeline duration changes

- Multi-lingual staff and translated web portal

- Weekly project and dependent status reporting

- Amnesty/grace period support

- Direct contact with Project Managers

- Toll-free in-house Call Center support & recording

- Dedicated phone line

- Replacement copy assistance

- Fully-secured employee and employer web portals

- Online status check/document upload/download

- Email opt-in option for audit participants

- Hard copy document digitalization

- Supplemental audit communication templates

- Savings and performance guarantees

The Problem:

“We were always under the impression that our clients’ administrators/PPOs were ‘peeling back the onion’ on high dollar claims to ensure that they were being paid accurately. Appears that isn’t the case even though the documented protocols call for such reviews. We submitted a $1.8MM hospital claim, where the ASO applied their network discount and quickly cut a check for $1.2MM. After auditing the claim, the Optelcon network saved the client nearly $300,000!! We will be using this service in the future.” – – Healthcare Consultant.

The cost of healthcare continues to rise with no indications of slowing down!

- A recent PriceWaterhouseCoopers study revealed an 84% increase in the just the last 10 years.

- From 2010 to year-end 2013, $1 million+ claims increased by 1,000% and the trend continues.

- The medical costs trend for 2017 shows another expected 8-10% increase.

- With the ACA excise, health plans must continue to decrease spending.

- Medical and Drug advancements continue to add to increased costs.

We utilize a three-tiered approach to saving claim payors on high-dollar claims that ensures the most effective solution is applied on every referral so that we are able to obtain the highest level discount possible for our clients.

- Our most effective approach is to Negotiate settlements directly with providers. All settlements are completed with a sign-off from the provider. As such, our network has never had a settlement withdrawn or repealed.

- Unfortunately, some providers refuse to negotiate or settle claims. When this occurs, our expert coders thoroughly review and analyze billed charges with a Medical Bill Review and Audit which many times uncovers coding errors, unbundling, and even fraud.

- Another strategy is to utilize our team of financial & insurance experts who are consistently monitoring true Usual & Customary fees, and apply their expertise and data to ensure that our clients are not overpaying for services. The proper use of this strategy involves a complimentary analysis of the plan’s Summary Plan Document or Certificate of Insurance to confirm the appropriateness of applying UCR. This strategy, many times, provides the client with savings that can be as high as 90% off of billed charges.

Negotiated Settlements

Our network of Certified Self-Funding Specialists, Certified Medical Coders, Certified Medical Billing Experts, Certified Municipal Finance Officers, Registered Nurses, and Master Negotiators work together to obtain savings for our clients.

- The only Medical Claims Settlement SpecialistsTM in the industry.

- In-network & out-of-network high-dollar medical claims.

- Signed provider releases with no signed release ever being rescinded.

- Continuous discount agreements.

- Example: $75,000 in radiation therapy treatment. Negotiations secured a 40% discount, or $30,000 in savings per treatment.

Medical Bill Review and Audit

- Reviewed by Certified Medical Billing & Coding experts for coding errors, unbundling, duplicate charges, etc.

- We apply the Centers for Medicare & Medicaid Services rules and guidelines.

- All audit recommendations and findings are compliant with federal and state statutes.

- AMA guidelines and referenced coding norms are also utilized and referenced.

- Example: $2.7MM premature infant claim with PPO allowed amount of $1.5MM. Medical Bill Review & Audit found over $900,000 in savings

The Problem!

“It’s impossible to serve as a fiduciary while not having access to claims data, the ability to hold providers accountable by auditing detailed bills or providing transparency in cost and outcomes to guide participants.” – Forbes, May 26th, 2016

The term “overpayments” refers to healthcare reimbursement claims that were, for whatever reason, paid at an amount higher than the amount owed by the health plan to the recipient.

There are many different causes of overpayments, such as duplicate billing, third-party liability, outright billing fraud, and several others. Many overpayments are impossible or prohibitively difficult to avoid; even the best-run plans commit them. In fact, overpayments are a relatively predictable phenomenon…and a costly one. Providers also utilize new billing technologies and Revenue Cycle Managers to create billing strategies in order to creatively get around administrators’ claims adjudication and payment processes in order to Maximize Revenues!

A 2014 report estimated the global average cost of overpaid health claims to be about 7% of all claims. The most recent analysis of Medicare claims puts the figure at 13% for the fiscal year 2014. What’s more problematic, recently expanded coding rules make claims even more complex! Health plans that rely on third-party administrators (TPAs) to administer claims on their behalf are believed by some to be at even greater risk. Although, self-funded employers using carrier TPA services under an ASO arrangement are also at great risk as these administrators DO NOT (although claim that they do) audit claims prior to payment, nor do they provide access to any of your claims data nor do they offer analytical reports to help you better manage your plan assets! In addition to those challenges, many times their own Network Provider Agreements actually protect those providers from audits and also disallow the application of standardized billing/coding rules set by CMS, OIG, NCCI, and other government regulatory agencies thus forcing the Plan Sponsor to overpay!!

Furthermore, health plans’ contracts with providers typically include an explicit right to recover overpaid claims. Of course, some overpayments are difficult and costly to detect. And detecting an overpayment is not the same as recovering it. Out-of-network providers, for example, may have little obligation or incentive to refund an overpayment. And a fraudster who has been put in jail – or fled the country – can be nearly impossible to collect from. And of course, recoveries take time – several months to several years after the paid date, depending on the situation.

The Solution!

Clients can reduce their medical claim costs by 2-4% or more off of their annual medical spend, and routinely receive double-digit returns on investment, by performing a Comprehensive Medical Claims Audit and Recovery project which only requires a total of approximately 8-10 hours of the client’s time over the course of the entire project (9-12 months in length). In addition to the opportunity for economic return, our audits help health plans and fiduciaries fulfill their legal and managerial responsibilities.

Audits are one of the most direct steps one can take to show that they have met their legal obligations in assuring that all plan expenditures are warranted and that plan assets are not misspent.

Our solution is a COMPLETE solution—Planning/Customization, Data Intake/Verification, Analysis/Audit Execution, Audit Reporting, and Full Recovery services that deliver recovered funds directly to the client. The various comprehensive audit modules utilized are as follows:

Recovery from Third Parties

- Coordination of Benefits (COB)

- Medicare primary payment (aged, disability)

- End-Stage Renal Disease

- Duplicate payments (multiple payers)

- Subrogation

Claims Overpayments

- Claims for non-covered benefits

- Claims in excess of employers’ Specific Stop Loss

- Payments greater than the charge

Provider Payment Validation

- Medicare Correct Coding Standards: (un-bundling, up-coding, excess billings, etc.)

- PPO Missed Discounts

- Duplicate Payments (provider paid twice)

Cases for Focused Follow-up

- Potential divorce

- Other insurance unknown

- High dollar cases

Eligibility Verification

- Payer Eligibility File Tests

- Claimants not on payer eligibility file

- Claims incurred outside periods of payer eligibility

- Employer Payroll File Tests

- Claims paid for members, not on employer’s payroll file claims incurred outside periods of employer eligibility

- COBRA Eligibility File Tests

- Claims paid for formerly covered persons, not on COBRA file –

- Claims incurred outside COBRA eligibility dates

- Other Eligibility Verification Results

- Overage dependents

- Retired members still active on health plan

Our network’s Post Audit Follow Up and Collection activities have analysts continuing to monitor claim payments and recoveries, reviewing payer collection efforts, and challenging case closures, where warranted. This results in Process Improvements and a more effective and efficient adjudication process for the client on a go-forward basis.

The Problem!

“It’s impossible to serve as a fiduciary while not having access to claims data, the ability to hold providers accountable by auditing detailed bills or providing transparency in cost and outcomes to guide participants.” – Forbes, May 26th, 2016

Healthcare costs are still on the rise, and pharmacy is a significant driver of that cost. With Medical inflation still in place but flattening, pharmacy inflation on the other hand is at its HIGHEST point in history!

Many sponsors of prescription drug benefit programs have operated on blind faith for too long. They have depended on their pharmacy benefit manager (PBM) to deliver safe and effective prescription drug coverage to their plan members while helping to reduce costs. The problem occurs when the plan sponsor relies on their PBM to tell them how they are doing. This is something akin to the ‘fox guarding the hen house’. To make matters worse, prescription benefit programs and PBM business practices remain some of the most opaque operations in health care (see our Industry News page for a number of articles on this important subject!). It is almost impossible for a plan sponsor to fulfill their fiduciary obligations without some type of independent, third-party oversight. This is where outside auditing and monitoring come into play. Let’s take a look at the reasons why:

PBM contracts are extremely difficult to validate on your own

The PBM Services Agreement is filled with plan definitions that dictate how terms are identified and open up the possibility for varied interpretations. PBMs contract separately with the plan sponsor and the pharmacy providers, thus creating ‘spread pricing’. Contracts also forbid any criticism from the Rx providers, sponsors, or auditors, and the terminology used is extremely ambiguous and ill-defined (MAC, Single Source Generics, AWP, Claims Exclusions, etc.)

Wiggle-room

PBMs prefer language that is vague and provides wiggle-room, meaning that a definition can be molded to comply with the business practice being deployed, usually benefitting the PBM. For example, even very basic definitions such as ‘Generic Drugs’ where Plan Sponsors are surprised to learn that drugs that should qualify as a generic (thus obtaining a greater discount) can be re-characterized as a brand (receiving a smaller discount), all at the discretion of the PBM.

Maximize savings to the Plan

The above-mentioned ‘wiggle-room’ also gives the PBM the flexibility to define pricing and rebates. For example when the PBM re-classifies manufacturers’ incentives into something other than a rebate or pricing discount. These lost savings accrue to the PBM’s shareholders rather than to the plan!

ERISA requirements

The health and welfare plan that includes the pharmacy benefit, may require an independent audit as part of the financial reporting to the Department of Labor. It’s IMPOSSIBLE for the plan’s financial audit to be completed accurately if the PBM’s performance is not also validated.

Fiduciary obligation

PBMs fight furiously to exclude themselves from being identified as a fiduciary in the vast majority of PBM contracts. As a result, the designated fiduciaries have an extra burden to make sure that the plan is performing.

Formulary Development and Plan Design

Formularies are designed for PBM profitability, not health outcomes. PBMs maintain brand medications on the formulary when much less expensive Therapeutic alternatives are available and ‘rebates’ do not offset the price difference.

The Solution!

Clients can reduce their pharmacy claim costs by 10-25% or more per year, and routinely receive double-digit returns on investment, by performing a comprehensive Pharmacy Claims Audit/Recovery and On-Going Monitoring project which requires very little time and resources on behalf of the client. From a Retrospective Audit and Recovery perspective, clients can expect to recover on average 3% of their total annual spend for every year that can be audited. Most PBM agreements’ audit provisions allow between 24 and 36-month retrospective audits, with some provisions allowing audits back “to the date the contract was executed”. Additionally, an audit can identify whether plan members are paying the correct copays and whether drugs are being adjudicated properly. Via our On-Going Monitoring program, our network works with our clients to monitor the performance of the PBM on a monthly and quarterly basis to ensure compliance and identify recoveries and other areas of savings in near real-time – why continue to fund your PBM with overpayments on an annual basis?! Via On-Going Monitoring, we will ensure that you keep funds within your organization for the operation, success, and growth of your business!

Pharmacy Costs Continue to Rise with no signs of slowing down!

- CMS is projecting an 86% increase in their annual pharmacy spend by 2020

- CDC Reports

- 48.5% of persons using at least one prescription a month

- 27.7% of persons using 3 or more prescriptions a month

- 10.6% of persons using 5 or more prescriptions a month

- 15.5 million people enrolled in HSAs and High Deductible Plans in January 2013. That is an INCREASE of 2 million people in only one year. Thus employees are taking on an even higher burden of these rising costs.

- The current Solutions are not working: i.e. formulary plans, PBMs, mail-order programs, rebates, etc. Optelcon’s best-of-breed partner network approach is poised to revolutionize various areas of healthcare. When it comes to pharmacy costs, our network provides a significant cost savings tool that focuses on EDUCATING, MOTIVATING, and EMPOWERING members and payers of prescription drugs to SAVE MONEY (upwards of 44% to members and over 20% overall to the Plan). Our Pharmacy Price Transparency Tool offers employers an advocate and aligns with them to dramatically reduce their pharmacy spending. This is accomplished using transparency software to educate and engage your employees. By using our network to educate employees on savings opportunities, employers offer a benefit and empower employees with information, saving both parties money. Our program measures success based on hard numbers and the raw data feeds we get from our payer clients. Therefore our network can quantify results based on actions taken and deliver savings measured in real dollars. This allows employers to track our value and return on investment. Our network’s tools will proactively educate your employees and members with a personalized action plan to save them (and you) money. This proactive reach-out to membership is done via the use of email and text messaging where your employees are directly engaged to take charge of their healthcare spending. A sample text sent directly to the phone of a member could read: On average, employers are overspending by 22% and historical data has shown that payers save an average of 5-6 times what their employees save. So, every $1 in out-of-pocket savings to the members translates into $5-$6 in savings to the Plan.

FAQ

Who is eligible for these services?

All health plan members are eligible for PBM Audit-Recovery & On-Going Monitoring services.How does a member register for this service?

Members register their account by going to a dedicated website and entering in their last name, date of birth, and SSN. Once registered, members may request a review of their medications or they will be registered to receive proactive savings alerts on their mobile phones and/or emails.How did Optelcon get the member’s information?

The network provider receives member information from the health plan and its vendors. Optelcon’s network is a benefit to all eligible participants and their spouses/dependents to advocate and coach them on methods to save on their prescription drugs. They have a team of pharmacists that search for ways to save and send alerts to the members regarding those opportunities.How is member information used?

Optelcon’s network partners only use members’ information (demographic identifiers, prescription data, etc.) to find savings opportunities. They do not sell member information or release any prescription-related information to the health plan. The employer does not see any prescription-related information.How do I save money?

Once your member receives a text or email alert from one of our partners, they log into their account and look for the personalized report in the “Reports” section of the member’s personalized account. A member can then download and print this guide complete with details on what savings were identified and step-by-step instructions on how to take advantage of that savings. For every $1 you save on your membership, the plan sponsor saves ~ $6!Who do I contact with questions?

Should a member have any questions regarding his/her savings report, dedicated team members and numbers will be supplied to the Plan Sponsor and the members to address any questions.How do I know Optelcon has my employees’ best interests in mind?

Optelcon has created a network of healthcare cost containment specialists that are pre-screened and passionate about saving their clients and their members’ money. We have spent many hours researching creative ways to save and want to deliver that information to you. Optelcon’s network will only deliver savings opportunities to members where real savings are possible. We ask members to always consult their physician, as we (and our registered pharmacist who supports this product) do not seek to replace members’ relationships with their physicians or pharmacists. We recommend members consider what we suggest because it will financially benefit them, and the plan, and is sound advice from a pharmacist.How does it work?

One of the companies in Optelcon’s network will alert your members via email and/or text message when they find a savings opportunity. Upon receiving the alert, the member will log into his/her account and download a personalized report with step-by-step instructions on how to achieve savings. Everything they need to secure the savings is included in the personalized report. A member may also log into his/her account and manually enter prescription details and associated costs to receive a personalized report.Why do members need to provide you with their email and mobile phone?

To maximize the methods by which we can contact your members about their savings opportunities, we ask that members register their email and mobile phone numbers. Members will only get a text message if there is an opportunity for them to save. We respect their privacy and will not contact any members unless they are able to save.How much will the members save? How much will the plan save?

On average, our network identifies upwards of 44% in out-of-pocket savings for the members which equates to an average of 22% in overall savings for the plan. Savings analyses have reached as high as 38% for overall Plan savings. For every $1 saved by a member, the plan will recognize as much as $5-$6 in savings.- “A savings opportunity of $562.83 has been identified. Login to your account to learn more!”

Healthcare fraud, waste & abuse costs the industry billions each year and is expected to increase with more people entering the system through the Affordable Care Act. The Fraud/Waste/Abuse (FWA) module can help with this through online, real-time prepayment editing of claims to find potential FWA conditions before you pay the claim. You’ll also be able to perform extensive data mining and analytics through access to our reporting database included with the module.

The Optelcon network’s Error Detection plays an instrumental role by utilizing advanced clinical editing (billing/coding Error Detection) technology to ensure that both institutional and professional claims are properly coded and compliant with applicable payer requirements. Error Detection examines the whole claim and identifies procedure-to-diagnosis mismatches, unbundling occurrences, use of nonspecific diagnosis codes, global service violations, potential unbilled revenue, and many other problem areas that can adversely affect not just claims to process, but a provider’s overall practice. This technology is deployed using cloud or client server-based technologies, and through the use of over 50,000 billing and coding error rules (based on commercial, Medicare, OIG, and Medicaid policies) resulting in millions of edit combinations, post-adjudication, and prior to payment of the claim, this technology identifies regulated billing and coding errors for both Professional and Institutional claims. Furthermore, customized rules can be created to meet customers’ specialized needs, and the unique editing, reporting, and workflow capabilities of our technology deliver significant cost advantages, maximum flexibility, quick implementation, and ease of use.

“Clinical Error Detection” as Opposed to “Technical Error Detection”: Errors are specific to the clinical coding aspect of the claim including unbundling edits, ICD/CPT® mismatches, global period violations, complete local medical review policies, correct coding initiatives, provider oversights and regulatory reporting whereas other solutions only edit technical aspects.

Average savings achieved from the utilization of this system ranges from 10% to as high as 30% and implementation is a matter of minutes! The system can utilize virtually any electronic file format and provides full HIPAA compliance under a secure internet connection to our highly secure Tier 4 data center (fenced facility, armed security, biometric entry, etc.)

FAQ

What do you mean by ‘Real Time’ Error Detection and why should I care about that?

Due to the real-time functionality of the technology, depending on the number of claims within each file submitted daily, the system will analyze each file within a few hours on average. Therefore, all claims are made available to the client quickly so as to not affect the timeliness of claims payments to providers. Our network’s automated solution allows us to provide claims in real-time and get a sub-second response for potential aberrations. No manual intervention is required, substantially speeding up our claims processing. Historical data is stored at the processing source to ensure rapid processing for the detection of aberrations like once-in-a-lifetime procedures and fraud, waste, and abuse

Why do claims have so many errors?

As medical billing and coding continue to grow in complexity, there is simply more opportunity for errors to occur and as a result, the national estimate is $380 Billion per year is overpaid as a result. Human errors from keying claims into systems. OCR scanning errors as a result of inconsistencies and system limitations. And of course fraudulent billing errors as a result of medical providers attempting to find ways to maximize reimbursement levels and revenue. Given the high costs of systems and labor involved with claims review, and how PPO discounts mask the problem for payers, these errors are quite often missed in the adjudication and payment process. Furthermore, with the evolution of the Affordable Care Act which resulted in more patients entering the system and providers’ cost-shifting to the commercial space, coding errors are increasing daily.

Why is Error Detection important to me?

Proper and effective claims editing can lead to a number of savings opportunities and can enhance payer fiduciary compliance and responsibility, sales/marketing, and reduce costs:

- Lowers administrative costs associated with processing claims –

- Improves compliance with reimbursement guidelines –

- Reduces audit risk/costs –

- Only adjudicate claims charges that are valid so avoid delays and costs of processing and vendor fees –

- Promote claims payment accuracy and due diligence –

- Identify any potential fraudulent billing via error reports generated by the system –

- Reduce expenses by streamlining the claims process workflows

How much can I save?

On average, the system will detect 10-30% of all claims reviewed showing errors. Of those claims detected, on average the savings will be 20%. In terms of dollars, on average each claim showing errors will reflect $300.00 in savings. As an estimate of savings, on a monthly basis, a population will generate one claim per life covered, per month.

Using 10,000 covered lives as an example:

- 10,000 claims per month

- 1,000 claims found to have errors (10%) On average, each claim will reflect ~ $250.00 in savings

- Total potential gross monthly savings = $250,000.00 thus an estimated annual, gross savings projected at $3,000,000.00

What is a billing/coding Error Detection system?

An Error Detection system provides a payer the ability to avoid the adjudication, process, and payment of any claims codes that should not have been included on the claim, to begin with, due to either basic errors such as data entry, OCR scanning errors, etc. or coding errors as a result of mistakes as they relate to complex coding requirements and protocols. By ‘cleaning’ the claim prior to any adjudication, a claims payer ensures accuracy and avoids the payment of charges that should be denied.

What type of errors does your system identify?

The system contains Millions of Editing Combinations that are all automated. This robust editing includes the categories noted below:

Unbundling / Bundling – component / comprehensive • Regulatory errors – CPT® based regulations • Potential Fraud, Waste, and Abuse situations • Medicare RAC rules • Procedure/Diagnosis relatedness including LCD, NCD, and CPT®/ICD • Code validity – deleted or truncated codes • Utilization errors – limited occurrence codes • Billing oversights – missing associated services • Miscellaneous edits – by report procedure • Documentation – supporting documentation needed • Linkage mismatch • Missing and invalid data • Common coding rules • Place of service • Compliance with specific payer requirements • CCI violations • Global period violations – the follow-up to global service • Fee schedule editing • Gender and age edits • Utilization and historical

How much do you charge? What are the implementation fees?

There are no implementation fees of any kind. The Optelcon Network can also provide a complimentary analysis of one months’ worth of past paid claims to show the types of errors the system would have captured on those claims and the associated savings. When the system does detect errors that equate to savings, Optelcon only charges a percentage of that savings as its fee. If no errors are found, or the errors found do not equate to immediate cost saving, there is NO CHARGE to run claims through the system.

Do you help support your Errors should a provider question or appeal the edit?

Yes. The system provides an EOB with a full description and detail for any/all errors detected. In fact, we suggest to all clients to include a toll-free number at the bottom of the EOBs on any claims where errors were detected and savings were incurred that connects that provider directly with someone who can answer that question and explain the edit. Another option offered to clients is the creation of a client-branded web portal where the URL for this portal, along with a unique code, is added to the bottom of the EOB allowing the provider to access the specific defense text/source for any identified error. Furthermore, the system can provide a myriad of reports that can be generated by the client and in real-time regarding any claim or any specific error that was detected. Due to the nature of the errors found, appeal rates are extremely low.

Medicare Referenced-Based Repricing

The US Healthcare landscape is more complex and experiencing more change than ever before. Plans are now realizing that significant savings can only be achieved through fundamental change, and reports show that out-of-network claims are billed at several hundred if not thousands of percent above the Medicare allowed rates. Medicare Reference-Based Repricing solutions are quickly becoming the standard for out-of-network claims or as a complete PPO replacement for many plans.

The advantages of implementing a Medicare Reference-Based pricing program are as follows:

- Save significant dollars on current out-of-network charges: at 200% of Medicare, the average Plan savings is 50%+.

- Emphasize accountability and better healthcare decision-making within the membership to increase In-Network utilization.

- A solution that drives deeper savings below Wrap Networks and Claims Negotiation services, AND carries a much lower % of savings fee.

- Medicare is a known quantity and provides transparency to the provider community vs. proprietary solutions.

What Makes Optelcon’s Out-of-Network Solution Different?

- Complete flexibility in the configuration of the program as it relates to applying various percentages of Medicare to various situations, specific providers, provider types, geography, etc.—even down to the line level of medical claims.

- Appeals Management Services: included within the risk-free contingency fee. Less than 5% of claims result in an appeal.

- Rapid turnaround times and electronic, automated claims transfers lead to efficiencies and lower administrative fees.

- Expertise in creating proper and effective algorithms for filling the ‘gaps’ for non-Medicare coding, and ensuring that proper Summary Plan Document language exists to support the program and protect the plan and its members.

- Our repricing engine utilizes extensive data sets to determine the prevailing price.

As noted, average savings using a base of 200% of Medicare rates is approximately 43% off average “allowed amounts” (or nearly 50% from billed charges). Most clients choose to use a basis of 150% of Medicare rates. At this percentage, savings are more in the range of 57% off “allowed amounts” (or nearly 65% off of billed charges). However, because our network’s repricing model is built on Medicare’s rates vs. a % of billed charges, savings could be higher or lower depending upon the specific billing practices and/or demographics of the provider.

We understand that all clients are not alike. That is why we will work with you to build a tailored solution that meets your specific needs. This is a turn-key cost management solution.

Savings Example: 10,000 Members

- Estimated Annual BILLED charges = $70,000,000

- Estimated Out of Network BILLED Charges = $3,500,000

- Estimated Savings:

– @ 200% of Medicare = $1,750,000 or 50%

– @ 150% of Medicare = $2,205,000 or 63%

The Problem:

- By 2024, nearly 1 in every 3 members of a health plan will have diabetes

- A diabetic is diagnosed every 30 seconds

- 80% of all claims over $250,000 involve diabetics

Diabetic populations pose a wide array of challenging issues including but not limited to the following:

- Non-Diabetic patients cost $2,864 per year vs Diabetic patients cost $9,975 per year

- Of all U.S. health care claims that exceed $250,000 annually, 80% involve diabetics.

- Diabetes Leads to Serious Complications. In 2009, 19% of all hospitalizations (114,977) were related to diabetes:

- 2,567 hospitalizations for Diabetic Ketoacidosis

- 1,222 lower extremity amputations

- 8,446 hospitalized for stroke

- 39,332 hospitalized with ischemic heart disease

- 23,328 hospitalized with congestive heart failure

- 15,605 Emergency Room visits

- Employers face lost productivity with chronically ill employees

- Health care dollars skyrocket

- Employees with chronic conditions that are unengaged or non-compliant

- The CDC provided the following stats:

- Total: 29.1 million people or 9.3% of the population have diabetes

- Diagnosed:21.0 million people

- Undiagnosed:8.1 million people ( 27.8% of people with diabetes are undiagnosed)

- What if chronic disease managers could know – in real-time – whether their diabetic patients are testing their glucose levels as instructed and also know the results of their daily tests?!

- What if somehow that information could generate automatic logbooks and reports that outline target ranges and compliance for every patient concurrently and over time?!

- And what if you could set up automatic alerts and “watch lists” for patients whose tests fall outside of the acceptable range?!

Objectives

The following are the primary objectives of The Optelcon Network’s Diabetic Management program:

- Control and decrease employer healthcare dollars

- Engage members of the diabetic population in order to promote self-management and compliance

- Increase compliance by decreasing demand on patients/members. For example, with the electronic meter, test results are auto-populated to the patient’s online account, eliminating the time and work associated with keeping a traditional logbook.

- Promote healthier, happier, and more productive employees thus creating value for both employee and employer

- Decrease incidence of exacerbation of chronic illness into acute episodes

- Decrease waste by providing additional supplies based on actual usage

- Create a value-added revenue stream

- Provide a seamless, comprehensive Diabetes Management and Implementation Program to employers

- Accurately track compliance/incentives with real-time data and custom reporting

- Decrease ER visits and hospitalizations

Our Blood Glucose Monitoring Program can provide these benefits and more. Through a partnership with Genesis Health Technologies, Optelcon’s network is now offering a program that is truly a “game-changer” for any chronic case management or disease management program dealing with diabetic members. Our network’s technology allows case managers real-time, instant access to patients’ glucose levels providing accurate and actionable information at their fingertips. Some highlights include:

- Accurately tests glucose levels and automatically sends results (via an included FREE cellular connection) immediately to the patient’s secure, FDA approved website, improving accuracy over self-reporting

- Test results are saved by date, time, reading, and whether it was pre/post-meal or a general read

- Data can be shared and accessed by:

- Treating physicians

- Case managers

- The patient

- Other caregivers or family members

- Immediate results of reads are sent securely via text(s) and email(s) to the patient designated receiver(s)

- Event-Based Calls can be made to patients due to a reading that is outside predetermined, acceptable ranges

- Devices are all pre-programmed, so the testing member needs only to charge the meter and begin using

- For Patient convenience, supplies are sent directly to patients on a quarterly basis – BASED ON USAGE to avoid over-purchasing.

- ALL OF THIS AND MORE FOR ONLY THE COSTS OF THE TESTING SUPPLIES!

– Meters, Mail Ordered supplies, Nurse assistance for compliance and target range calls, reporting, secure web portal, targeted messaging, etc. – NO COST

Case Management tools include:

- Case managers have access to all patients via a single website

- Patient Summary Reports

- Patient Logbooks

- Watch List

- Glucose Compliance Report

- Glucose Target Range Report

- Event-Based Notifications

- Participation Reports

- Utilization Report

Also, due to the fact all readings are recorded, this program eliminates test strip waste due to non-compliant patients. (It is estimated that approximately 65% of all test strips go unused!)

[Example of the many signs found all over the US]

Any day on the eBay website, one can find upwards of thousands of listings by individuals selling their unused test strips purchased by their health plans!

http://www.ebay.com/sch/i.html?_from=R40&_trksid=p2050601.m570.l1313.TR11.TRC1.A0.H0.Xdiabetic+test+strips.TRS0&_nkw=diabetic+test+strips&_sacat=0

If the patient only tests once/day, when their supply gets low, they will automatically be sent a three-month supply – enough strips to cover their average amount of testing. No waste. The “true savings” over the longer term as a result of the increased Engagement within the Plan’s disease management programs are reduced hospitalizations, less frequent ER visits, avoidance of other disease states, less prescribed pharmaceuticals, and overall healthier members!

Although low in occurrence, patients experiencing dialysis treatments can incur annual medical expenses that approach $1 million per year. These expenses can have a crippling effect on a self-insured employer group health plan and cause significant increases in stop-loss premiums as well.

Optelcon’s (RHCC) Dialysis Claims Settlement Program saves an average of up to 90% off billed charges and often as much as 75% off standard PPO rates. Billed charges can and do vary by a large margin. However, our program normally saves $300,000 to $750,000 each year.

Optelcon’s network utilizes a unique approach to saving money including negotiated settlements, Dialysis Pre-Authorization or Carve-Out programs, and U&C adjustment recommendations.

- Our first option is to attempt a negotiated settlement with the provider.

- Our second option is our Dialysis Pre-Authorization program which has the provider contact the payer prior to the first treatment. At that time, Optelcon’s partner is contacted and an agreement is attempted and structured.

- The third option is the review of the entire Summary Plan Document (SPD) to determine if the plan’s provisions contain a usual customary and reasonable (UCR) limitation or provision. If the SPD contains a UCR provision that is compatible with our database methodologies, we would suggest an adjustment recommendation based on UCR.

- Our fourth option is to create a Dialysis Carve-Out Program whereas dialysis remains a covered benefit and reimbursement methodologies defined, but outside of the primary PPO that is being utilized by the Plan.

Our average turnaround time for settlements is only 2 days. Should you need a case rushed, just ask and we’ll do our best to accommodate.

The average time for U&C adjustment recommendations is also 2 days. As with settlements, we accept special requests for expedited repricing.

Average savings history:

Average savings history:

- In-network claims using a signed release/settlement: 33%

- Out-of-network claims using a signed release/settlement: 71%

- Using an adjustment recommendation based on UCR: 90%

- Implementing a dialysis carve-out program: *91%+

*varies based on the multiple of Medicare utilized

Appeals happen. No program exists without appeals. And, when an appeal is received, we are here to help. We will review the provider’s appeal and provide you with a prompt response that can be used to formulate your own response.

To the right shows just one example of a person we saved over $645k in dialysis charges in just 10 months.

FAQ

What are dialysis treatments?

Dialysis treatments remove waste and toxins from the blood of a patient suffering from renal failure, allowing them to live without the natural ability to clean their own blood. Patients can be treated with Hemodialysis, which removes blood from the body and filters it through a machine and returns the cleaned blood back to the body, or Peritoneal Dialysis, which uses the peritoneum and a neutral solution called dialysate within the patient’s peritoneum to remove the waste by osmosis.

What is “ESRD”? How long does this illness typically last?

End-Stage Renal Disease (ESRD) is the point when the kidneys stop working and can no longer adequately remove waste toxins from the blood. ESRD is often the result of untreated diabetes and/or high blood pressure. ESRD is permanent so the only way to reverse the condition is through a kidney transplant.

Why is dialysis so expensive? Why do charges range from $40K to $100k per month?

The biggest factor in the price rise of dialysis is the consolidation of the industry. There are two major providers that make up two-thirds of all dialysis facilities in the country. Both are publicly traded companies that need to please their stockholders as well as their patients. Another reason dialysis is so expensive is due to the patient mix. For the average dialysis facility, approximately 85% of their patients are primarily covered under Medicare/Medicaid and the remaining 15% of the patients have commercial insurance as their primary coverage. The providers often shift costs to the commercial payers to make up for the lower reimbursement rates paid under the aforementioned government programs.

How does Medicare apply to dialysis?

Medicare maintains a separate category for ESRD patients. Patients become eligible to apply for Medicare on their first date of dialysis. The majority of dialysis patients have Medicare part B as their primary payer.

How long should we wait before we send in our dialysis claims for discounts?

The earlier we receive notification from the payer the better the chance of our success. Please review the codes below which can be used to identify impending dialysis cases as well as existing cases.

We recommend looking for the following codes that could indicate a dialysis patient is on the way:

- ICD-9-CM: 585.1 to 585.6, 585.9 and 586

- ICD-10-CM: N18.1 to N18.6, N18.9, and N19

- CPT Codes: 36800, 36810, 36815, 36011 and 36147

- The following codes indicate that a patient has started treatment already:

- HCPCS/CPT: J0882, J0886, J1270, J1756, J2501, J2916, Q4081, 90935, 90937, 90940, 90945, 90947, 90989, 90993, and 90999

Can becoming trained in-home dialysis affect the Medicare waiting period?

Yes. When a patient completes home training, the three-month waiting period for ESRD Medicare is waived and the 30-month coordination period begins.

Can transplant patients have more than one Medicare ESRD Coordination Period?

Yes, if the patient’s kidney transplant fails after the 37th month, there is an additional 30month coordination period with Medicare as the secondary payer, although there is no three-month waiting period in the second coordination period.

Can we pay for the first three months of dialysis differently than the remaining 30 months?

No, payers should pay the claims with the same methodology in the first three months as they pay the claims for the remaining 30 months of the coordination period.

Why can’t I just buy a dialysis machine?

Only a doctor can purchase a dialysis machine and a patient needs a prescription from a doctor to start dialysis.

What is a dialysis pre-authorization program?

It is a cost-saving program where group health plans add a dialysis pre-authorization phone number to their benefit card requiring dialysis providers to call our partner before patients begin treatment. This first point of contact with the provider is when allowable charges are first discussed and we work to negotiate the best possible rate.

What is a good example of plan verbiage?

Good plan verbiage provides group health plans the means to prudently manage their assets by clearly defining covered, non-covered, excluded, and allowable charges.

Now with access to more than 1 million Healthcare Providers, our network routinely penetrates over 82% of claims with average savings in the area of 25%.

Our network’s Wrap PPO Network combines with (or “wraps around”) your selected Primary PPO network enabling maximum benefits and savings when your members’ claims fall outside your Primary PPO. We continually strive to provide the most extensive PPO wrap network coverage in the country and deliver timely results through a single-source solution.

Negotiations…

In adjunct to our Wrap Network strategy, our network can include our Negotiations program on an automated referral basis. Assuming our Wrap program is the last attempt at network reductions, all claims that remain out-of-network can be immediately assigned to one of our expert negotiators. Once in their hands, they will contact the provider to attempt a settlement on the claim. Of course, customized parameters are set upfront to accommodate clients’ specific needs such as the implementation of negotiation thresholds: for example “a minimum negotiated a discount of X%”.

On average, our network negotiates successful savings outcomes on over 50% of the cases we attempt, with average savings of ~22%.

Optelcon’s network provides a national laboratory network that provides savings to its clients on an average of 85% off of billed charges. As a comparison to those rates, the average Medicare reimbursement is approximately 88% below billed charges for Lab.

We provide national coverage offering over 2,100 locations nationwide should a patient choose to visit a draw station, or for even further convenience a patient’s physician can perform the draw in the office as long as the specimen is sent to our network for the analysis.

On average, Laboratory services represent upwards of 4%-4.5% of total medical spend and utilization is approximately 8-9 lab claims per year, per covered life with a billed charge average of $250-$300. With a savings average of 85% below the billed charge (or on average 30% below a payer’s current charges after PPO discount), our partner’s Lab Network can offer significant savings via a program that is also extremely easy to implement.

Qualifications:

- Cannot have a direct, contracted arrangement with our network provider already in place.

- For Primary Network usage, the payer must add the network logo on the ID card and educate members and physicians regarding the use of the network when sending out specimens for analysis. No logo is needed for application to out-of-network claims.

- Must be able to include specific language on the EOB when sending in payment to ensure proper adjudication and posting of that claim payment.

Process:

- Any/all lab claims are sent electronically for re-pricing.

- Claims are re-priced within a 24-hour cycle with appropriate reductions for any in-network claims submitted.

- All other claims will show as ‘Non-Par’ which can then be sent through the primary PPO to capture a reduction.

- A monthly savings report and invoice will be provided

Optelcon can perform a complimentary savings analysis for anyone interested in this program. Simply provide the last year’s paid claims data for Lab in an Excel format. Within 3-5 business days, Optelcon will supply a detailed analysis of the potential savings.

FAQ

Does the member have to go to specific locations to get their blood drawn?

No. Due to the structure of the program, a patient may have his/her treating physician perform the blood draw in the physician’s office. Or, if the member prefers, he/she may go to one of the network’s over 2100 draw station locations throughout the country.

Why utilize a program like this for my group health benefits program?

Group health payers can experience up to 85-90+% savings on any/all lab tests. We have yet to receive any past claims data from an interested payer where we were NOT able to offer significant savings. Rates in our exclusive, national lab fee schedule have not increased in over 10 years and are nearly as aggressive as the Medicare allowable.

How is Optelcon’s network able to do this?

Via exclusive distribution arrangements with national lab partners, Optelcon’s network partners are able to provide access to a very aggressive fee schedule for any/all lab services. Due to its aggressive nature, our partner will only allow us to offer rates at this level if the payer can meet the requirements noted above in this document.

How much does your service cost?

Optelcon can offer its network’s Lab solution under 1 of 2 different models – a PEPM model or a shared savings model, whichever is preferred by the client. No implementation fees and no fees for any due diligence such as savings analysis or Summary Plan Document reviews.

How do we get started?

To implement the program, the payer needs to:

- Execute an Optelcon Scope of Work and Payer Agreement

- Create/test an electronic connection to send a claim for re-pricing Add the network logo to the ID cards. This is to help educate the members’ physicians as to what lab must be used when sending out specimens for analysis.

- Educate membership and physicians of this new primary lab network. (Optelcon’s network partners can assist in this area at no cost.)

- Preferably on a daily basis, all lab claims are sent electronically for re-pricing. Claims will be returned in an overnight cycle noting any/all claims that ‘hit’ the lab network and resulted in a discount. Any claims not associated with the lab network will be returned as Non-Par.

How many facilities are in The Optelcon Network’s nationwide network?

Approximately 1500 facilities in 25 states. Optelcon’s network also provides experts in building free-standing networks for our clients in areas where we may not currently have full coverage

What lab tests are available through Optelcon’s network?

Under Optelcon’s network lab network solution, more than 92% of all 80,000 series lab codes are included. Those not covered include various DNA tests and other more complex analyses, many of which are performed in an In-Patient setting. For any lab code that is unable to be priced under Optelcon’s network lab fee schedule, the client can simply submit those claims to the general PPO to secure savings.

Diagnostic radiology is the fastest-growing component of the medical expense.

- 20% growth rate

- 2x faster than prescription drugs and faster than overall healthcare spending

- Upwards of 10%+ of Total Medical Spend

- $100 Billion in annual spending on imaging in the U.S.* (expected to double in the next four years)

Our Radiology Network & Concierge Service is a system set up by Optelcon’s network to better manage the cost and service of highly utilized and expensive diagnostic procedures such as MRI, CT, Arthrograms, CTA, MRA, and P.E.T./CT Scans. Through our actively managed Radiology Network, we direct patients to highly credentialed imaging facilities at greatly reduced rates and pass these savings on to you. Optelcon’s network includes an executive management team and scheduling department with a combined experience of over 250,000 diagnostic claims managed which resulted in more than $250 million in savings Nationwide Coverage.

Due to our innovative contracting strategy with our network providers, Optelcon’s network is able to provide our facility partners with a more valuable relationship as compared to the standard network relationships that exist today. As a result, we can secure a more aggressive rate schedule and greater savings for our clients, while at the same time delivering higher service levels to members.

Advanced radiology procedures continue to grow in cost and utilization. Most health plans experience anywhere from 10-13% of total membership having one of these studies ordered on an annual basis.

The key highlights of this program are as follows:

- NO FEES!! This program is 100% Free to implement and utilize. No PEPM, Percentage of Savings, implementation, or per bill fees what-so-ever

- Average diagnostic test savings of 50% per procedure, or upwards of $400 per test. Full Patient and Physician Concierge Service to ensure efficiency, accuracy, convenience, and a positive patient experience

- A quality guarantee on all radiological images ordered through Optelcon’s network program

FAQ

What is a Radiology Network & Concierge Service?

Our Radiology Network & Concierge Service is a system set up by the Optelcon network to better manage the cost and service of highly utilized and expensive procedures such as MRI, CT, and P.E.T. Scans for the group health and Workers’ Compensation industries.

What is ‘Concierge Service’?

For every referral received, an Optelcon network Care Coordinator will work with the patient and the patient’s treating physician to A. secure a copy of the prescription as the final QA of the official prescription for the test. B. perform Patient Pre-Screen to ensure placement of the patient in the proper facility. C. utilize mapping software to locate the most convenient location for the patient. D. reminder call to the patient the night before the test. E. provide driving directions and test preparation. E. send appointment notification to treating physician and pre-cert nurse. G. secure the medical report and proactively send to the ordering physician and pre-cert nurse if applicable.

Why utilize a program like this for my group health benefits program?

Group health payers can experience up to 40% savings on these highly utilized exams while actually increasing the level of service to their claimants/employees. Average savings nationwide per test is $500. A standard company should find that 13+% of total lives will need an MRI/CT or P.E.T. each year. Therefore, a 5,000 life company could save as much as $325,000.00 per year! Referrals can be made by phone, web, fax, e-mail, or by having the physician call. The average time on the phone for a referral is only 3 minutes! For 3 minutes of the member or physician’s time, the Optelcon network will save you $400. These savings are unparalleled.

How is the Optelcon network able to do this?

The Optelcon network has set up an actively managed Diagnostic Network of highly credentialed diagnostic facilities. We are able to direct patients to their centers at greatly reduced rates and guarantee a more rapid reimbursement. We in turn pass these savings on to our clients. We’ve set up a win-win-win scenario. The centers see patients that they would not normally receive, the payers pay less for the same exact tests, and the patient has the convenience of choosing their own facility that guarantees quality. Everyone wins.

How much does your service cost?

Nothing. No “per-member/per-month” fees, no percentage of savings fees, and no access fees. Our services are absolutely FREE. You simply pay a flat, global fee for the technical and professional components of the imaging test. The savings we capture for the payer are concrete bottom-line savings.

How do we get started?

Instruct clients or members that you would like them to utilize the Optelcon Network’s Radiology Benefits Management program. The Optelcon Network will take care of the implementation, and help educate adjusters/employees on the benefits of the services and how to use them. The Optelcon Network then provides all the coordination of these tests including, intake, pre-screening, offering directions to the facility, report procurement, and billing. Simply give us a call and we can arrange for a 30-minute meeting to go over the program in detail. If you can spare 30 minutes, you will learn how to bring these immense, free savings to your clients or group!

How many facilities are in the Optelcon Network’s nationwide network?

Approximately 1100 facilities in 32 states. The Optelcon Network’s team is also an expert in building free-standing networks for our clients in areas where we may not currently have full coverage

What diagnostic tests can be scheduled through Optelcon Network’s Healthcare?

MRI – MRA – CT Scans – P.E.T. Scans – Arthrograms – CTA

How long does it take to receive the medical report once the test is scheduled?

The average turn-around time from scheduling the exam to the medical report in hand is 4.5 days.